Congratulations to Our Shadow Board Members for 2025

We are proud to welcome and congratulate our newly appointed 2025 shadow Board Members! Your leadership, dedication, and vision will play a vital role in driving us forward.

We look forward to a year of growth, innovation, and success under your guidance. Wishing you all the best in your new roles!

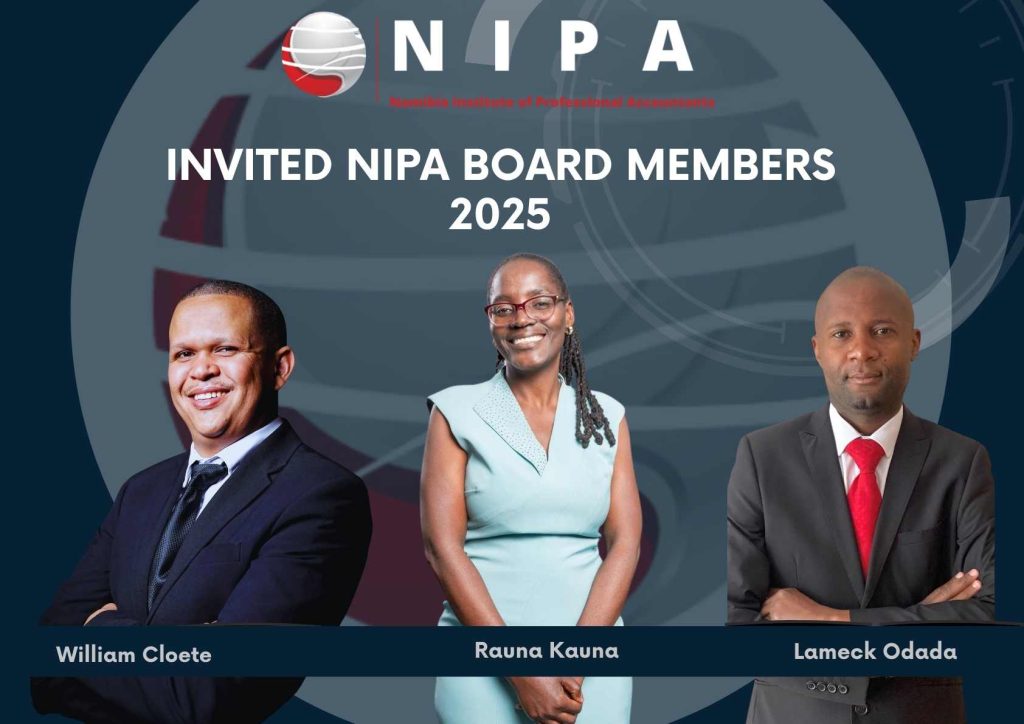

Congratulations to Our 2025 Invited Board Members!

We are proud to welcome and congratulate our newly appointed 2025 Board Members! Your leadership, dedication, and vision will play a vital role in driving us forward.

We look forward to a year of growth, innovation, and success under your guidance. Wishing you all the best in your new roles!

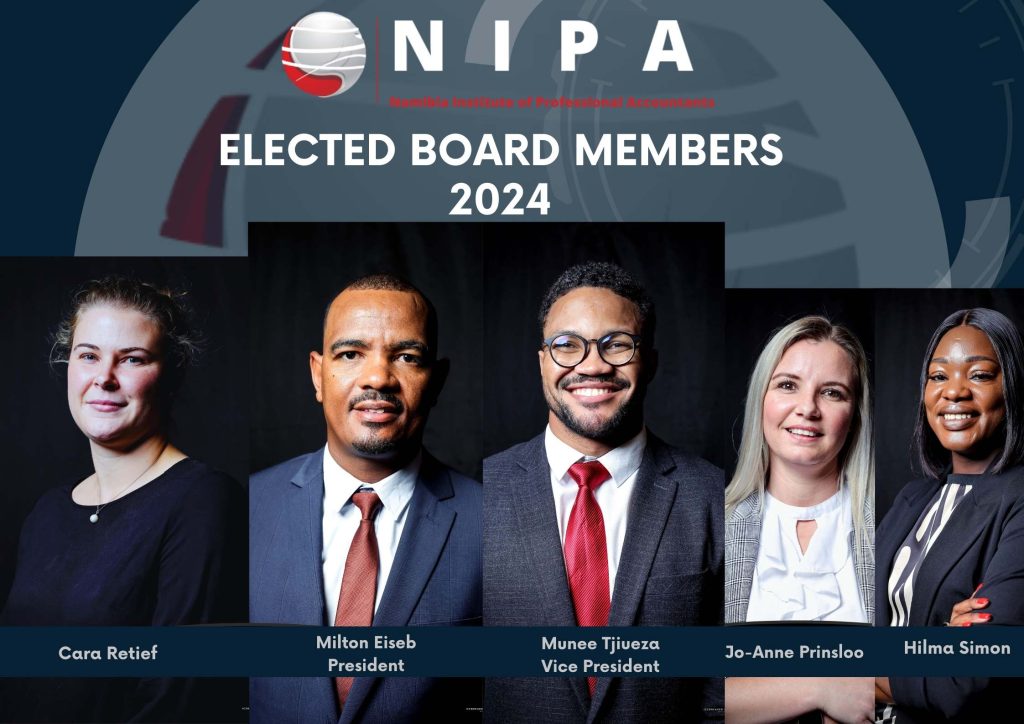

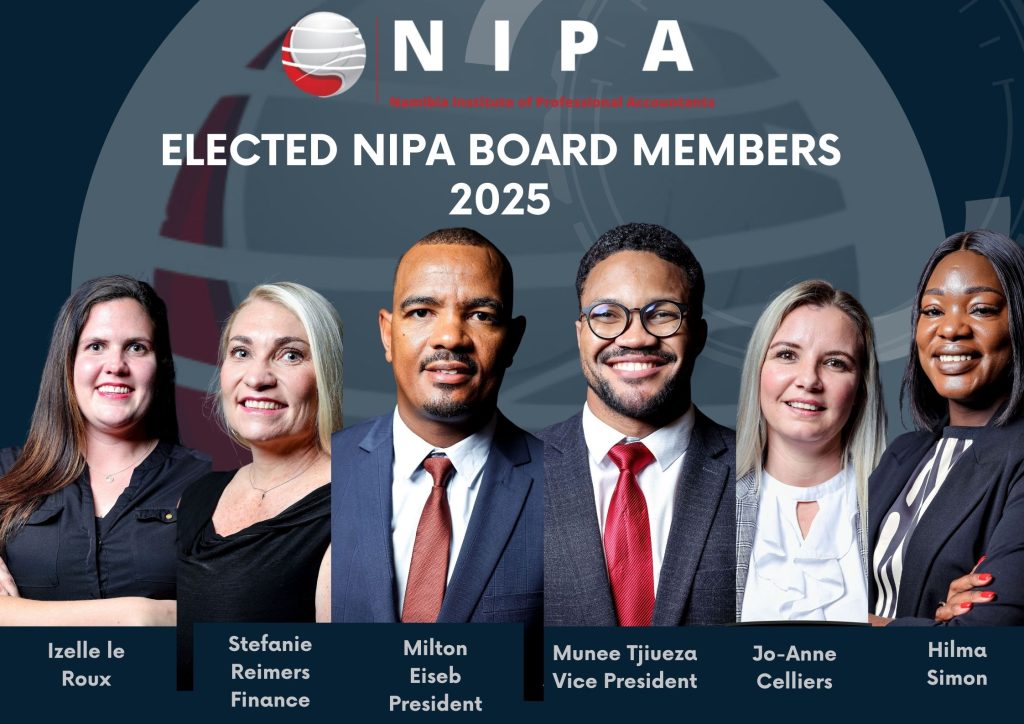

Congratulations to Our 2025 Elected Board Members!

We are proud to welcome and congratulate our newly appointed 2025 Board Members! Your leadership, dedication, and vision will play a vital role in driving us forward.

We look forward to a year of growth, innovation, and success under your guidance. Wishing you all the best in your new roles!

We are thrilled to announce a momentous achievement in our journey towards international accreditation. As of today, 15 November 2023, we have been admitted as a member of the esteemed International Federation of Accountants (IFAC),

Application date has been extended to 5 June 2023.

NIPA does not provide practical training. We have 37 Accredited Training Centers in Namibia. Candidates that wish to enroll for training must obtain employment at any of these Training Centers.

- Degrees in Accounting: NIPA acknowledge degrees that are certified by the Namibian Qualification Authority with a NQF level 7. Candidates are advised to confirm with NQA regarding their qualification and receive written confirmation

- Diploma in Accounting: NIPA acknowledge diplomas that are certified by the Namibian Qualification Authority with a NQF level 6. Candidates are advised to confirm with NQA regarding their qualification and receive written confirmation

- Partly completed degrees: NIPA acknowledge partly completed degrees for our Accounting Technician route but the results must be certified by the Namibian Qualification Authority with a NQF level 6. Candidates are advised to confirm with NQA regarding their qualification and receive written confirmation

Follow the route to membership:

- Trainee Accountants: SUB COMITTEES\MARKETING\NIPA 2021 Brochure corrected.pdf

- Trainee accountants needs to have an Accounting degree for admission and be registered with an Accredited Training Center. Practical experience must be obtained over a 3-year period. The training covers the Financial reporting, Financial Accounting, Management Accounting, Corporate Law, Ethics and Taxation competencies.

- On completion of all the competencies of practical experience, the trainee is subject to a written IPD assessment.

- Trainees may exit the program to be awarded Accounting technician designation or

- progress to Membership, which includes a written PE Assessment.

- Trainee Accounting Technicians: All persons with at least a Higher Education Certificate

may enroll for training, provided that they are registered for an accounting degree or

diploma and employed by an Accredited Training Center

- These candidates follow the same route as Trainee Accountants except that they are allowed at least 7 years to complete their academic qualification and practical experience. Upon completion of the academic qualification and completion of the practical experience, they are subject to a written IPD (as for trainee accountants). The designation Accounting Technician is awarded to them if they are competent.

- Trainees may exit the program to be awarded Accounting technician designation or

- progress to Membership, which includes a written PE Assessment.

- Accounting Technicians: The RPL program makes provision for experienced adults without

the full academic qualification to register under this program.

- They may exit the program when the academic component is achieved and proof of practical experience is documented. Competency in a written IPD is required to obtain the designation.

- These candidates may exit the program to be awarded Accounting technician designation or

- progress to Membership, which includes a written PE Assessment may also proceed to full membership.

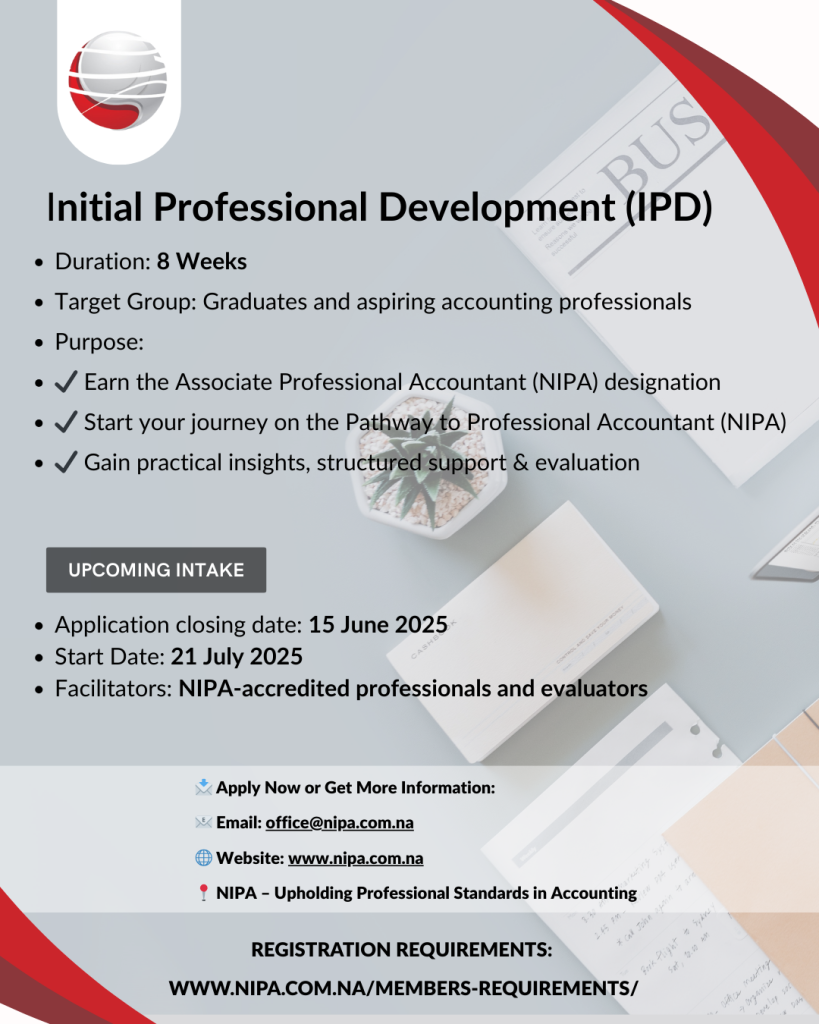

- Compulsory preparation for assessments (iPD and PE) a 20-week online program was developed to assist candidates (trainees and accounting technicians) to prepare for the written IPD and Professional Evaluation, which is the final component before admission.

NIPA 022 developed complete training material on all the standards of IPSAS. The material includes presentations, activities, homework and solutions. An Assessment is to be completed at the end of each standard to proof competency. Nipa grades the assessments. We provided training to 69 Accountants at various levels of the City of Windhoek with exceptional results.

- NIPA is an Institute that regulates the Professional Accountants and Accounting Technicians in Namibia. We are currently a voluntary organisation but will be regulated by the Accountants and Auditors Regulatory Authority once the Act is promulgated.

- Our main objective is to: (i) advance the accountancy profession and contribute to the development of the profession to provide high-quality services in the public interest; (ii) uphold and enforce a high standard of efficiency and professional conduct by all members; (iii) institute and implement investigative and disciplinary processes with penalties that include suspension of, or expulsion from, membership; (iv) provide continuous professional development (CPD) for members and ensure compliance with CPD requirements; (v) promote the application of internationally accepted accounting practice and standards; (vi) establish and accredit training programs or centers and as well as trainers in accountancy and to regulate such training schemes and centers.

Our values are:

- Integrity – honest, reliable, trustworthy & credible

- Ethics – principled, fair & just

- Excellence – quality, superiority, objectivity & urgency

- Professionalism – qualified, certified expert, skilled & confident

- People centeredness – understanding, accepting, empathic & polite

Services that are being rendered to the Public includes:

- Compliance Officers/Reports: Accountants review organisation systems, financial statements, accounting principles while assessing the accuracy of the organizations financial records. The accountant responds by issuing a report on annual financial statements and also act as Accounting Officer for Close Corporations.

- Taxation: Accountants in public practice advise their client on all relevant tax matters through efficient tax planning, filing of tax returns, resolve tax problems, advise on tax implications and generally aid the clients with personal financial affairs.

- Financial Management: Budgeting, cash flow forecasts, business plans and advice on corporate structures are skills that are delivered to clients.

- Management Consultancy: Advise clients on the management of their businesses and aid them to be more profitable and effective.

- Secretarial and Accounting Services: Design and implement accounting systems, capture and record financial data and assist clients to comply with various requirements of the Close Corporations Act, Companies Act, Income Tax and Value Added Tax legislation.

Some of the services that our members perform are

- Prepare Financial Statements

- Tax compliance

- Record, monitor and interpret financial results

- Advise and install reporting cost accounting and computer systems

- Budget Administration

- Project management

- Capital expenditure

- Compile and prepare management reports

- Improve internal and production controls

- Develop future plans

- Perform the role of financial manager or accountant, financial director, treasurer, controller,

- company secretary, cost and management accountant, tax specialist, internal audit.

We keep a detailed register of all our members and trainees. We do not publish the list, but members of the Public may request if a specific person is a registered member.

- NIPA strive to upskill and reskill our members in the latest legislation and developments in the Industry. We wish to ensure members of the Public that our members deliver a high standard of quality work that complies with international standards and uphold high ethical values. Our members are subject to compulsory 120 hours training over a 3-year period. Our skills transfer is in the fields of Financial Accounting, Financial Reporting, Management Accounting, Ethics, Practice Management Quality Assurance and 4IR.

- The Institute provide the training and monitors compliance. Non-compliance may lead to disciplinary and suspension.

- Members of the Public may lodge complaints of unprofessional conduct against members of NIPA to the Secretariat of NIPA in the form of a sworn affidavit and provision of evidence. The secretariat will acknowledge receipt and if the complaint is valid, investigate such complaint. We are assisted by Senior Councilors of the Namibian Bar.

- All Practicing members must have compulsory Professional Indemnity Insurance.

- All members are issued with a certificate of membership. You may request such certificate. Certificates are withdrawn upon resignation or termination. All resignations and terminations are published on our social media. You may request confirmation from our offices.

- Our Code of Conduct is on the website. It is unprofessional conduct if the member accepts work that he/she is not qualified to perform.

- Our members may not distribute or share any information of clients to third parties.

- It is required that for all services, your Accountant must:

- Issue you with an engagement letter that specify the duties that must be performed and what the responsibility is regarding such services. Engagement letters are issued every 3 years, unless the engagement has changed.

- Issue you with a written quotation for the work to be performed. A member may not proceed with the work unless it is approved by the client in writing

- Members may request upfront payment for the services that they need to deliver.

Our Continued Professional Development (CPD) are presented to both our members and trainees and may be attended by the Public. The program is widely advertised on our social media.